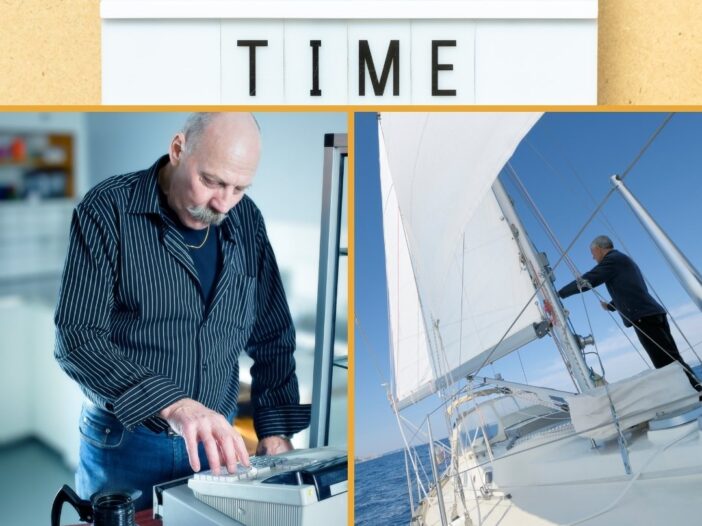

Retirement doesn’t have to be a leap from “hero to zero”, with your working life ending on Friday and retirement starting Monday. (Or if your partner has already got a ‘to do’ list for you, starting 8am Saturday morning!)

Semi-retirement is a way to ease yourself from the rigidity and pressure of full-time work into the mindset of time to do what you want. It also allows you to continue to earn, keep your “business brain” active, and be part of your work social circle.

Stay on with your current employer

Given the current shortage of skilled workers, your employer may be more than happy for you to reduce your working hours rather than retire completely. Better to have your expertise on hand than looking for the equivalent in a sparsely-populated pool of experienced candidates.

You can request flexible working from your current employer using a statutory request. According to the Citizens Advice Bureau:

“This is a request which is made under the law on flexible working. This means there’s a process set out in law that you and your employer need to follow when you’re negotiating your flexible working request.”

Flexible working covers a range of arrangements, according to ACAS:

To ask for flexible working, you must meet certain criteria, including having worked for your employer for 26 consecutive weeks when you make your application. For more information see the government website on flexible working.

Move on to a new job

If you’re looking for change of scene, or a new challenge, you can look at jobs with other employers in your marketplace (current contract willing). Other companies may be more than willing to have you on board even for just a couple of years, as they struggle to fill their own vacancies. You might “fill the gap” of their own employees who has gone part-time themselves, or become one half of a job share with another existing employee.

Business networking meetings can be a great way to sound out other companies outside your sector as to the skills requirements they may have. Many networks offer potential new members a free or discounted trial meeting, a low-cost way to meet a lot of business folk in one place!

Less stress, more enjoyment

You may not want the level of stress and responsibility in semi-retirement as you had in your full-time role. This will often involve taking a drop in salary and seniority, in return for a more relaxed – and enjoyable – work experience. Here are two examples:

- If you love driving and meeting people, you might want to get your private hire licence to work as a self-employed private taxi driver for a private hire firm. You can usually pick your own hours, jobs and even use a company vehicle rather than your own.

- If you like the idea of appearing on screen alongside major Hollywood actors, even just for a nanosecond, why not consider becoming a Supporting Artist (extra)? It’s not quite as glamorous as it sounds, and the hours are long, but you will be paid, fed and watered. See the Facebook group Heavy Pencil for insights into being an SA.

So, if you’re one of the 52% of Brits who dream of turning their hobby into a job or career, or the 33% of UK workers who want to change career for a better work-life balance, semi-retirement could be the answer.